Meaning of FinTech

FinTech is a new innovation that uses technology to improve activities in finance. FinTech has a tremendous scope to provide workable solutions to the problems faced by traditional financial institutions. It broadly stands for Financial Technology. A range of benefits can be delivered by FinTech innovations. India has created the platform to establish itself as a global FinTech hub. The emergence of numerous FinTech start-ups, accelerators and incubators over the last few years was a major reason for that. The RBI has setup an inter-regulatory working group to study the regulatory issues related to FinTech.

The term ‘FinTech’ has been around for quite some time ,it is incumbent to take a fresh look at the industry in the face of rapidly changing technology and forays into the field by many players . The financial technology industry comprises of technology-enabled firms offering financial services, as well as entities providing technology services directly to financial institutions.

What do FinTech’s do?

FinTech companies employ technology to support financial transactions among businesses and consumers. Technological advances, changing demand for financial products and competition in financial services are all driving a new wave of FinTech start- ups and investments that have drawn attention to the industry in the recent years.

Startup companies are creating products and services to penetrate new areas of the financial system and to change the competitive landscape. These new forces are motivating traditional financial firms to invest in technology and to pay attention to changing trends among their customers. All new and incumbent players will be impacted by the changes we see happening in the marketplace today. But understanding the space and focusing on key developments amid all the hype can be a challenge.

We seek to focus on 3 FinTech areas in this discussion, namely: Digital Lending, Payments and Blockchain. These are of particular interest due to their rapid pace of growth, technological disruption, and regulatory and other risks. While some of these areas represent FinTech sectors themselves, blockchain is a technology that carries the potential for innovation across multiple segments of the financial landscape.

Regulation of Fintech Products and Services

There is no universal regulatory body for FinTech entities in India. Depending on the product or service offered by the entity, the regulatory body governing such vertical would regulate those specific entities. By and large fintech products and services can be considered to fall under the purview of the following regulators:

- the RBI;

- the Securities Exchange Board of India (SEBI);

- the Ministry of Electronics and Information Technology (MEITY);

- the Ministry of Corporate Affairs; and

- the Insurance Regulatory and Development Authority of India (IRDAI).

However, the RBI currently regulates the majority of fintech companies in India dealing with account aggregation, peer-to-peer (P2P) lending, crypto-currencies, payments, etc.

DIGITAL LENDING

Digital lending implies to technology-driven nonbank lending. Access to expansive data, sophisticated algorithms and considerable computing power enabled new companies to compete with traditional banks by providing appealing new offerings to would-be borrowers.

Company participants typically have digital platforms to facilitate funding. Borrowers include consumers and small businesses, with individuals and institutional investors providing capital. Offerings range from consumer and student loans to small-business loans, equipment-financing loans and lines of credit. Mortgages and auto loans are other emerging areas. Digital lending companies match borrowers and lenders, thereby benefiting from loan relationships and processing transactions.

As of FY17, India’s household debt per GDP is only 11% compared to 49% in China and 78% in the USA, indicating that there is a huge gap to fill the under-utilized financing capacity. Further, access to credit is so limited in India that rather than asking who can’t access formal credit, the more relevant question in the Indian financial set-up is, who can access formal credit? As per World Bank data, less than 10% of Indians have access to formal credit.

Advantages of Digital Lending

Digital lending has significant advantages over traditional lending, with the potential to address prevalent credit-related challenges in India. One of the most distinguishable advantages of digital lending is speedier approval of credit. Credit evaluations and loan disbursals on digital platforms have visibly quicker turnaround times than traditional loans – particularly for small-ticket credits and advances, which are most common among new-to-credit borrowers.

Some of the factors why the disbursal turnaround time is significantly lower in digital lending are due to the following reasons:

- Replacement of manual form filing by digital data captures

- Automated evaluations leveraging on technologies like advanced analytics, artificial intelligence (AI) and machine learning (ML)

- And no or little in-person visits.

Digital lending models are addressing the huge unmet demand for credit. India’s digital lending market will see a CAGR of 36% by 2023, while the Digital lending (excluding mortgages) is a total addressable market of $1 trillion in the U.S., and loan origination volumes could reach $90 billion by 2020 from about $25 billion in 2015.

PAYMENTS

The Indian Payment Industry is a thriving market which is set to grow on an exponential scale and here’s why,

- Total transaction value in the Digital Payments segment is projected to reach US$69,168m in 2020.

- Total transaction value is expected to show an annual growth rate (CAGR 2020-2024) of 5% resulting in a projected total amount of US$141,256m by 2024.

- The market’s largest segment is Digital Commerce with a projected total transaction value of US$57,574m in 2020.

- From a global comparison perspective it is shown that the highest cumulated transaction value is reached in China (US$1,920,536m in 2020).

The proliferation of smartphones and the emergence of mobile payments and blockchain technology have unlocked innovation across the system. This is primary to three areas in particular: Person-to-person payments, In-store retail payments, and Credit and Debit Card Transaction Processing and Settlement.

Person-to-person (P2P) payments refer to the transfer of funds from one personal account to another, using either the Automated Clearing House system or debit/credit cards. Providers of this service include banks and technology firms such as PayTM, PayU , Razorpay etc. . ACH transfers cost less to process than credit or debit card transactions. This is simply because they bypass the assessment fees charged by card networks. National Payments Corporation of India (NPCI) has implemented “National Automated Clearing House (NACH)” for Banks, Financial Institutions, Corporates and Government a web based solution to facilitate interbank, high volume, electronic transactions which are repetitive and periodic in nature.

BLOCKCHAIN

Despite a complex infrastructure, the goal of blockchain technology can be summed up simply as decentralization. The aim is to decentralize through a shared ledger of transactions.

The three main components are a peer-to-peer network with randomized groups, or nodes; a database, or digital ledger; and third parties. When a third party submits an entry or payment, to the ledger, the nodes work together seamlessly to either approve or reject transactions. With no central authority, this eliminates the need to trust one party such as a payment processor. Everything is time- stamped and protected by cryptographic signatures, or complex algorithms that provide data integrity. As such, if any party attempted to retroactively adjust transactions, it would be visible to every node in the network, essentially making transactions fully immutable once submitted.

For the sake of convenience we use a real world example. Since the late 1930s, if you ever needed transportation for hire, you would either call or flag down a centralized taxi cab service. Today, it’s as simple as opening your Uber or Ola app on your connected device and dropping your pin to notify taxis of your location from a decentralized pool of drivers for hire. Such change eliminates the need for an intermediary taxi cab company, while details of the transaction are easily authenticated (price, time, distance), efficient (cutting down wait time for a taxi) and transparent (fully visible to other drivers in the area).

The blockchain infrastructure is more promising, with diverse potential applications that could reshape how business is conducted across payments, loans and trading. Blockchain could prove to be a disruptive technology in the financial services industry. Due to that potential and to the enhancement of three important characteristics: Authentication, Efficiency and Transparency.

Key Uses for India

The NITI AAYOG Report of January 2020 outlines a number of areas block-chain technology can help India which includes:

- Better contract management and procurement,

- Greater accountability and quality control across supply chains,

- And decentralization of authority in decision making

Niti Aayog specifically described several use cases for which it had been experimenting on using blockchain technology.

The first was using a blockchain to create a new system to manage land records. The second was using it for the pharmaceutical drugs supply chain.

The third was using blockchain technology for educational certificates to fight fraud.

Other use cases the institute mentioned include the immunization supply chain, chit funds, insurance such as medical and automotive, EV battery swapping, organic farming, and energy trading.

Growth Prospects for FinTech in India

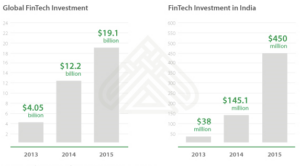

The traditional financial services have globally undergone a radical transformation that has been brought about by technology and innovation. In 2015, more than 12,000 start-ups sprouted in the FinTech space across the world. This included a massive investment of USD 19 billion. In true sense, FinTech comprises of technology–based businesses that are competing against enabling or collaborating with existing financial institutions. These companies also collaborate with universities and research institutions, government associations and industry bodies.

The industry is likely to continue its current growth trajectory. The global Fintech software and services sector predicted to touch USD 45 billion by 2020 at a CAGR of 7.1%.

India has created an ecosystem that provides start-ups an opportunity to exponentially grow into big businesses. This goes right from exploring into a range of unexplored segments to engaging with foreign markets.

It is unquestionable to say that the Fintech start-ups are delivering innovation that was previously difficult to achieve. The Indian Fintech software market is poised to touch USD 2.4 billion by 2020. This is a drastic increase from USD 1.2 billion in the Financial Year (FY) 2016.