Investing in equities isn’t just a matter of deciding which shares or funds to buy and which markets to buy them in. Investor strategies are as varied and colorful as the people who employ them and it is unprecedented that rarely do investors stick to a single strategy.

Long and Short Positions

When you take a long position you hope and expect that the security will appreciate in value over time but when you take a short position on a stock you expect the price of the securities to fall. Long investors actually maintain ownership in the underlying business. That is, they actually own the shares in which they invest. Stock “shorting” is an interesting phenomenon that allows investors to profit by selling shares of stock which they do not actually own. But, at some future point, the investor must buy the securities to cover his or her short position that was previously sold.

The most sophisticated investors, including hedge funds, employ both long and short positions simultaneously to protect their exposure to risk.

Distressed Investing

This may not be the first choice for every investor. Companies in financial distress are often targets for some investors. Distressed investing does not come without its risks. However, operating in this world can prove quite lucrative. Just ask Warren Buffett who doubled-down on Wells Fargo during the financial crisis or the debt (not equity) holders in Enron or Worldcom.

In many cases, distressed debt can pay double digits above that of the typical Treasury yield. Investing in distressed businesses requires a great deal of confidence that the underlying business can perform a successful turn-around. Hedge funds, private equity and even some mutual funds pursue this strategy.

One way for an individual to take advantage of this type of investment is exchange-traded debt. Alternatively, you can enter the bond market as a hedge fund would.

Distressed companies may have already filed for bankruptcy or will file soon. You can find out in company announcements or the media whether a company has filed for bankruptcy or not. You can also review a company’s bond ratings via Moody’s or Standard and Poor’s.

Income Investing

One of the most conservative Investing Strategies is the Income Investing. The first and foremost priority of such an investment is preservation of capital for an extended period. Retirees and others on fixed-incomes often rely heavily on investment income for regular and recurring expenses. Hence, an income strategy is more common among this demographic. Income investors tend to focus on dividend paying shares – firms that distribute their profits to their shareholders rather than retaining it within the company. Dividends typically come from large, mature firms in industries that are no longer rapidly expanding.

Dividend yields are the dividend payout per share expressed as a percentage of the share price.

Value Investing

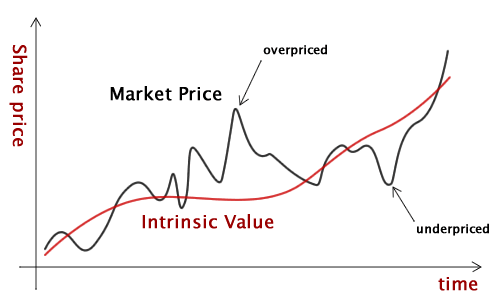

Value investing is an investment paradigm that involves buying securities that appear underpriced by some form of fundamental analysis. High-profile proponents of value investing, including Berkshire Hathaway chairman Warren Buffett, have argued that the essence of value investing is buying stocks at less than their intrinsic value. The discount of the market price to the intrinsic value is what Benjamin Graham called the “margin of safety”.

Hedge fund manager Seth Klarman has described value investing as rooted in a rejection of the efficient market hypothesis (EMH). While the EMH proposes that securities are accurately priced based on all available data, value investing proposes that some equities are not accurately priced

Performance of value strategies

Value investing has proven to be a successful investment strategy. There are several ways to evaluate the success. One way is to examine the performance of simple value strategies, such as buying low PE ratio stocks, low price-to-cash-flow ratio stocks, or low price-to-book ratio stocks. Numerous academics have published studies investigating the effects of buying value stocks. These studies have consistently found that value stocks outperform growth stocks and the market as a whole. A review of 26 years of data (1990 to 2015) from US markets found that the over-performance of value investing was more pronounced in stocks for smaller and mid-size companies than for larger companies and recommended a “value tilt” with greater emphasis on value than growth investing in personal portfolios.

Criticism of the Value Investing Strategy

When value stocks perform well, it may not mean that the market is inefficient, though it may imply that value stocks are simply riskier and thus require greater returns. Furthermore, country-specific factors have a strong influence on measures of value (such as the book-to-market ratio). Also, one of the biggest criticisms of price centric value investing is that an emphasis on low prices (and recently depressed prices) regularly misleads retail investors; because fundamentally low (and recently depressed) prices often represent a fundamentally sound difference (or change) in a company’s relative financial health. To that end, Warren Buffett has regularly emphasized that “it’s far better to buy a wonderful company at a fair price, than to buy a fair company at a wonderful price.”

Quantitative Investing

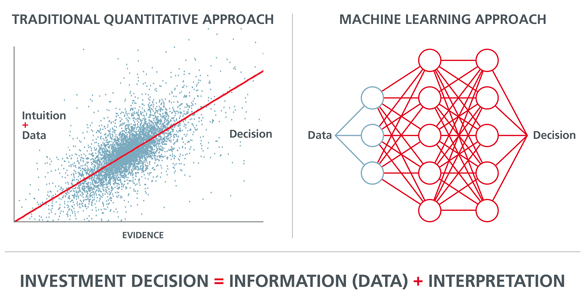

Quantitative, “quant” investing or systematic investing, as it is sometimes called, is a strategy that uses vast amount of big data resources in search for patterns that can be used for exploitation and profit by a group of investors. Many times a quant strategy involves looking for arbitrage opportunities within the data. It analyses advanced mathematical modelling, computer systems and data analysis to calculate the optimal probability of executing a profitable trade. Examples include high-frequency trading, algorithmic trading and statistical arbitrage.

Historically, quantitative trading has been the domain of sophisticated hedge funds, but as computational power and data storage have become commoditized, traditional institutional investors and fundamental funds have begun to borrow quantitative techniques and tools, such as machine learning, advanced mathematical modelling, factor investing and the use of alternative data, to make trading and portfolio allocation decisions.

Quantitative traders start by building a mathematical model of their proposed trading strategy, then they backtest it using historical market data. This process is susceptible to over-fitting whereby the model is constructed to work well in the specific time period or market conditions it is tested against but underperforms when it is made live.

Arbitrage

Arbitrageurs typically look to exploit various price disparities in the price of a specific security, currency or commodity. They will look at two different markets, analyze where the market is cheaper, buy the security cheaply and immediately resell on the market where the security or other instrument is more expensive. Arbitrage investing is time-consuming as it requires an active view of the markets in which the arbitrageurs play. True arbitrage has very low risk, however, because the prices of the buy and the sell are known well in advance of the transaction.

Risk Arbitrage

Risk arbitrage an investment strategy to profit from the narrowing of a gap of the trading price of a target’s stock and the acquirer’s valuation of that stock in an intended takeover deal. In a stock-for-stock merger, risk arbitrage involves buying the shares of the target and selling short the shares of the acquirer. For instance, such an investor may anticipate a transaction and thus seeks to profit on the expected changes that occur in the price of both the target and the acquirer’s stock. In most instances, risk arbitrageurs will purchase shares in the target to be acquired, assuming there will likely be a rise in the company’s stock. In some cases, the investors will also short the buyer’s stock, assuming the reverse will be true from the acquirer’s perspective.

There is risk here as mergers and acquisitions can often be cancelled for regulatory or other reasons. If this occurs, the investor may lose a significant amount of money.

This post is genuinely a pleasant one it helps

new net users, who are wishing for blogging.

GOOD JOB.